The buy to let market can still be lucrative in the long term despite the efforts of the government in recent times to increase the tax burden of landlords. But undeclared rental income can lead to fines and increased scrutiny by HMRC.

In 2019 alone, HMRC uncovered 11,129 cases of landlords underpaying tax or not paying any tax on their rental income, a 27% increase from 8,704 the previous year. If you’re a landlord, make sure you understand how rental income is taxed and the consequences of not disclosing to HMRC.

How is rental income taxed?

Any rental income you receive from monthly rent, non-refundable deposits and money from tenants for repairs, will need to be declared. The total amount is submitted to HMRC and the amount of tax owed is dependent on the tax band your total income falls into.

If being a landlord isn’t your sole job, the income you make still needs to be declared. The amount of income you receive will be added to your income from other forms of employment or investment too and the tax you pay will be worked out on the total.

Do I need to pay Class 2 National Insurance?

As a landlord you will only be required to pay Class 2 NIC if you are regarded as running a property business. If the following criteria all apply then you need to look at this further:-

- being a landlord is your main occupation

- you rent out more than one property

- you’re constantly looking to expand your portfolio and buying new properties to rent out

You will need to pay Class 2 National Insurance if your profits are over £6,725 a year and you are regarded as running a property business. If that is the case, you can make voluntary Class 2 National Insurance payments to make sure you qualify for the full state pension provided your profit is less than £6,725 a year.

If you just own a few buy to lets and do not change these from year to year you will probably not be regarded as running a property business.

If your total earnings from property do not exceed £1000 (not very likely in most cases) you will be able to claim a property allowance of £1,000 and receive this income tax free.

If you have UK and overseas property, the rental income will need to be calculated separately for each and not lumped together. If you’re unsure, speak to your accountant about buy-to-let or go to https://www.gov.uk

How does HMRC find out about my undeclared rental income?

HMRC has access to information about every property and land transaction. Rental income is certainly an area of increasing scrutiny for HMRC and the land registry lists are being checked. If no rental income is listed with them, but there is a second property listed in your name, it will give them cause to make enquiries.

What happens if I don’t declare rental income?

If HMRC suspects a landlord has been deliberately avoiding tax, it can reclaim 20 years’ worth of tax payments. They can also impose fines up to the total value of any unpaid tax, as well as the underpaid tax.

HMRC’s Let Property Campaign and undeclared rental income

HMRC’s Let Property Campaign gives individual landlords the chance to bring their tax affairs up to date with the best possible terms to pay the tax you owe.

If you owe tax on your letting income, you’ll need to tell HMRC about the income you haven’t declared by making a voluntary disclosure.

To get the best possible terms, you must tell HMRC that you wish to take part. You’ll then have 90 days to calculate and pay what you owe.

How to make buy-to-let work for me

Despite recent changes in regulations for private landlords, the buy-to-let market can still be profitable. You need to know how to make the best use of your tax breaks, understand which financial structures are best for your portfolio and know the best places to secure financing.

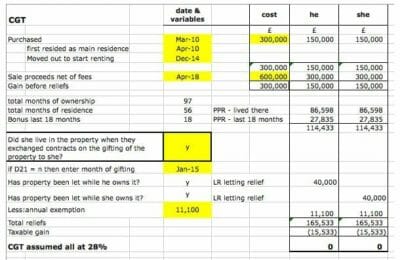

When it’s time to sell your property or properties, you should also make sure you seek professional advice regarding the calculation of Capital Gains Tax. Take a look at our own CGT service here to see if it fits your needs.

For more practical advice and business insights, you can follow us on Twitter and LinkedIn.

About Jon Pryse-Jones

Since joining THP in 1978, Jon Pryse-Jones has been hands on with every area of the business. Now specialising in strategy, business planning, and marketing, Jon remains at the forefront of the growth and development at THP.

An ideas man, Jon enjoys getting the most out of all situations, “I act as a catalyst for creative people and encourage them to think outside the box,” he says, “and I’m not afraid of being confrontational. It often leads to a better result for THP and its clients.”

Jon’s appreciation for THP extends to his fellow team members and the board. “They really know how to run a successful business,” he says. He’s keen on IT and systems development as critical to success, and he continues to guide THP to be at the cutting edge and effective.

Read more about Jon Pryse-Jones More posts by Jon Pryse-Jones