IMPORTANT NOTE – since publishing this piece we have received several calls to our own phone line from people who are clearly trying to contact HMRC. THP is an accountancy firm and has no connection to HMRC.

Getting in touch with HMRC can sometimes seem like an uphill task. As The Telegraph reported recently, thousands of taxpayers have been left on hold for hours after trying to phone. MPs have expressed serious concerns about call waiting times, blaming remote working for the delays. HMRC itself is trialling a text system in a bid to reduce call queues. However, this is geared towards people with routine requests and answers are automated. So what can you do if you need to contact HMRC more quickly and want to speak to a real human being? I think I have found an answer.

A simple tax return

We’ve just got to the end of the Self-Assessment Tax Return season. As a freelancer with a modest number of clients, I have a relatively simple tax return. So I tend to file mine close to the deadline.

So, on the day before the deadline, I consulted my accounts to pull out the figures I need to complete my tax return. I spent the morning checking everything was accurate and that I’d accounted for all my expenditure. I mostly had, although I realised I had failed to enter some of the mileage I’d accrued going to business meetings. Once I’d added that, I’d got the numbers I needed to submit my return.

I got online, filled in the return and got given a submission reference number. However, I didn’t get an email confirming my submission. I thought that odd as I’ve always received one in previous years.

Anyway, I didn’t worry. Then I tried to pay up.

For some reason, while the online system had worked out my tax, it hadn’t created a final bill. I had the correct numbers in front of me, but the system hadn’t deducted the two payments I’d made on account. Stranger still, a different part of the portal claimed I hadn’t actually submitted my tax return.

Maybe I’m imagining it, but I’m sure that in previous years I got an email and an instant calculation, allowing me to pay my bill immediately. Worried something might have gone wrong, my heart sank.

Oh no, I have to contact HMRC!

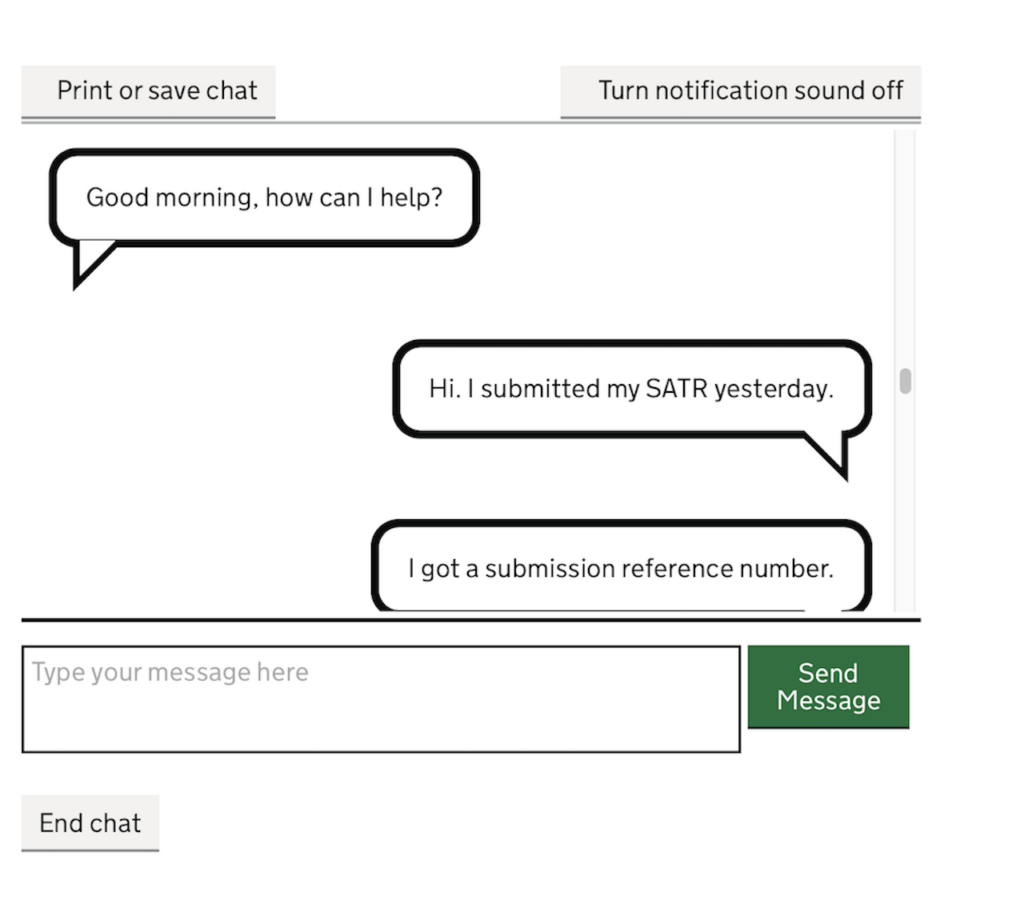

I knew I needed to contact HMRC, but I also didn’t fancy spending hours in a phone queue. So I looked around the online portal and found an option to open a web chat.

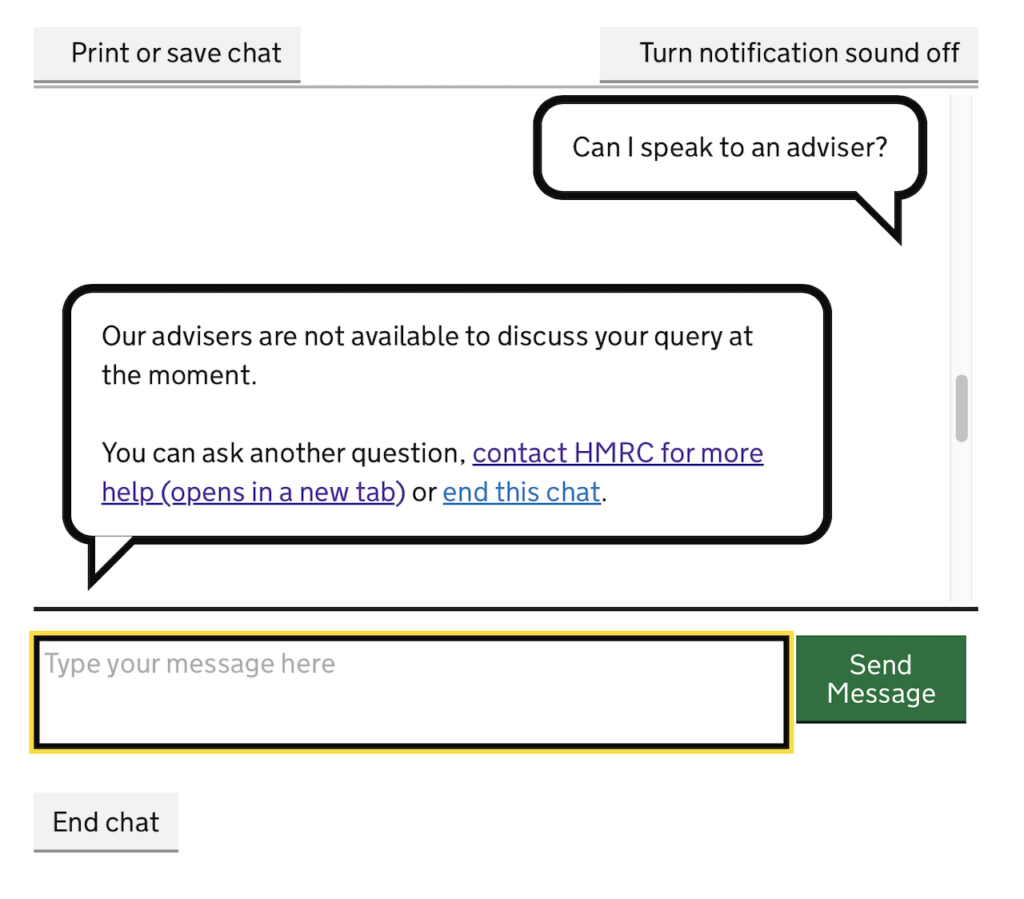

As you can see, I began to describe my problem. However, once I’d done this, I was annoyed to discover that the chat was being handled by a robot. I got directed to some web links that were of no use at all. So I asked to speak to an adviser. I was told “Our advisers are not available to discuss your query at the moment”.

That wasn’t much help, so I tried again. I asked: “How can I speak to an adviser?”

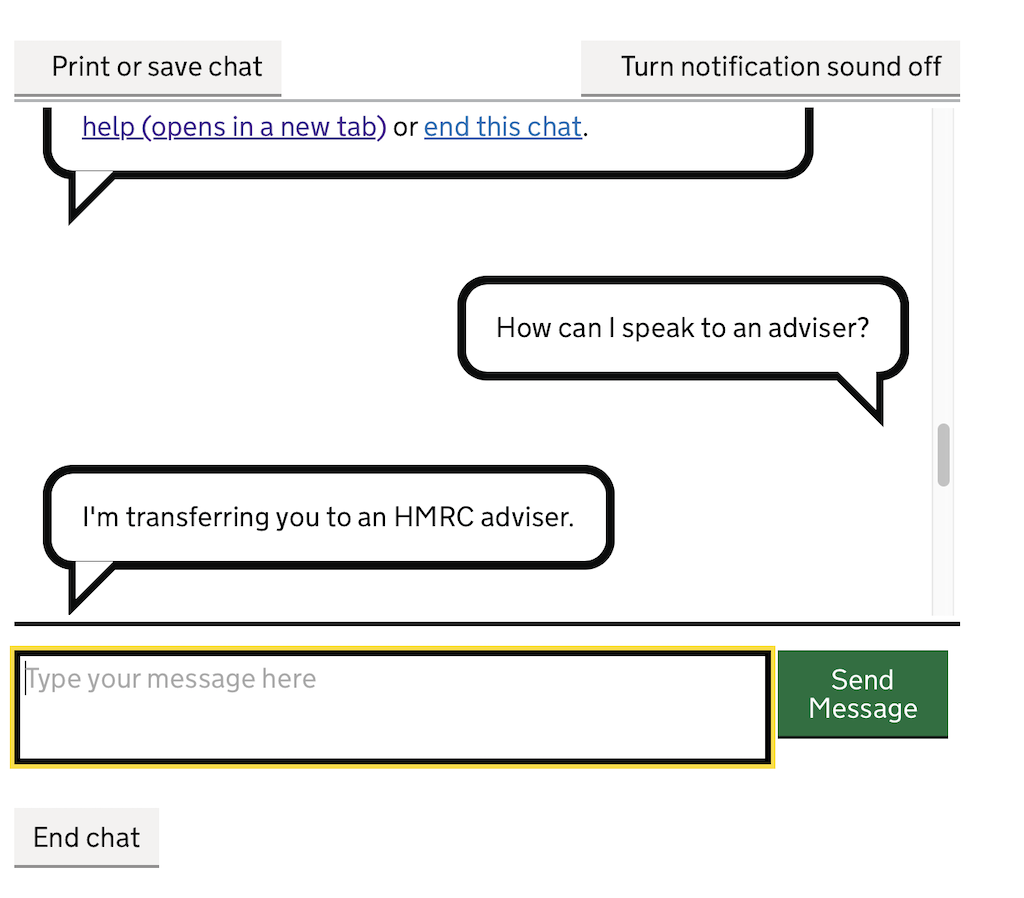

Amazingly, the chat robot replied: “I’m transferring you to an HMRC adviser”.

Waiting to speak to an HMRC adviser

At this point, the chat system said I was 60th in the queue and would have to wait 12 minutes. So I made a coffee and returned to my desk. Then, about 7 minutes later, a message from a real-life adviser popped up.

They were very helpful. Apparently I had to wait up to 72 hours for my online account to update. To avoid interest, I could do my tax calculation manually and then pay. The whole process took a few minutes. Then I made the calculation and paid up. Job done.

What I learned from contacting HMRC

The first thing I learned was to follow my own advice and do my tax return early.

The second thing I learned is that, with a bit of persistence, you can get to talk to someone at HMRC reasonably quickly. If you persist in telling the HMRC chat robot you want to speak to an adviser, you’ll get put through.

Of course, if you’re smart, you’ll ask a THP accountant to deal with your Self-Assessment Tax Return instead. That way, they’ll solve the simple queries for you, take care of communicating with HMRC and – of course – will do all they can to make sure you claim all relevant tax breaks and reliefs. If you ask me, that’s the best way of all to avoid HMRC’s phone queues!

IMPORTANT NOTE – since publishing this piece we have received several calls to our own phone line from people who are clearly trying to contact HMRC. THP is an accountancy firm and has no connection to HMRC.

About Ben Locker

Ben Locker is a copywriter who specialises in business-to-business marketing, writing about everything from software and accountancy to construction and power tools. He co-founded the Professional Copywriters’ Network, the UK’s association for commercial writers, and is named in Direct Marketing Association research as ‘one of the copywriters who copywriters rate’.