Budget 2025: what does it mean for you?

Posted by Ben Locker on November 26, 2025We covered the UK Budget 2025 as it was delivered to learn what the key announcements were, and what they mean for you.

Charging a company car at home? It’s tax free

Posted by Mark Ingle on November 19, 2025Do you charge a company car at home? If so, you’ll be glad to know that reimbursements are now tax free. We explain how the new system works.

Rental income and married couples: how does it work?

Posted by Ian Henman on November 17, 2025When it comes to rental income and married couples, different ownership structures can have different tax implications. We take a closer look.

Side hustle tax rules – HMRC is watching

Posted by Jon Pryse-Jones on November 14, 2025Side hustle tax rules mean we continue to see the taxman clamping down on people who don’t declare gig economy income. Here’s what you need to know.

Tax planning before 5th April 2026: your year-end checklist

Posted by Karen Jones on November 10, 2025Get clear tax planning advice before 5th April 2026. THP Chartered Accountants share key steps to use allowances and reduce your tax bill.

Income tax refunds – beware if they’re too good to be true

Posted by Jon Pryse-Jones on November 7, 2025If you’re offered income tax refunds that seem to good to be true, they probably are – as some people have discovered to their cost.

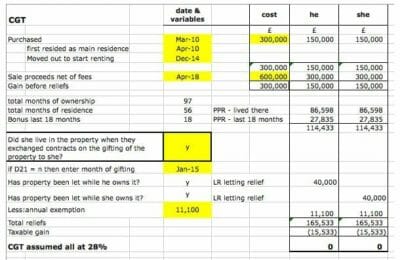

Capital Gains Tax on sale of property – express service

Posted by Kirsty Demeza on November 3, 2025Capital Gains Tax on sale of property – you have only 60 days to calculate the tax due, declare it to HMRC and pay over the tax.

Do I pay Capital Gains Tax on inherited property?

Posted by Ben Locker on October 20, 2025If you’re wondering whether you need to pay Capital Gains Tax on inherited property, THP’s clear and simple guide is here to help you out.

Changes to company winding up rules

Posted by Kirsty Demeza on September 29, 2025If you are thinking of disincorporating your business via a Members’ Voluntary Agreement, you need to know about changes to winding up rules.

The THP Guide to UK Inheritance Tax Planning

Posted by Ian Henman on September 17, 2025UK Inheritance tax planning – we explain how to calculate the tax due to the Treasury upon your death or the death of a loved one.