Tribunal ruling could result in Capital Gains Tax refunds

Posted by Karen Jones on December 3, 2025A tribunal ruling revealed HMRC had wrongly charged CGT on the sale of property, meaning many could be eligible for CGT refunds.

What HMRC data matching means for your finances

Posted by Jon Pryse-Jones on November 24, 2025HMRC data matching is reshaping tax compliance. Learn how automated data checks work, where errors arise and how you can protect yourself.

Charging a company car at home? It’s tax free

Posted by Mark Ingle on November 19, 2025Do you charge a company car at home? If so, you’ll be glad to know that reimbursements are now tax free. We explain how the new system works.

Side hustle tax rules – HMRC is watching

Posted by Jon Pryse-Jones on November 14, 2025Side hustle tax rules mean we continue to see the taxman clamping down on people who don’t declare gig economy income. Here’s what you need to know.

Income tax refunds – beware if they’re too good to be true

Posted by Jon Pryse-Jones on November 7, 2025If you’re offered income tax refunds that seem to good to be true, they probably are – as some people have discovered to their cost.

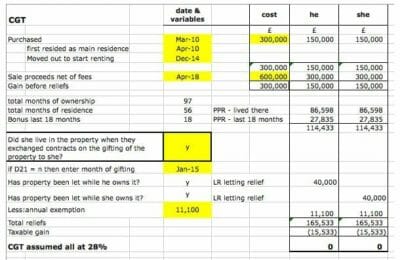

Capital Gains Tax on sale of property – express service

Posted by Kirsty Demeza on November 3, 2025Capital Gains Tax on sale of property – you have only 60 days to calculate the tax due, declare it to HMRC and pay over the tax.

IR35 checks – did you know you could do them online?

Posted by Jon Pryse-Jones on October 29, 2025IR35 checks are important for hiring organisations – get them wrong and it gets expensive. We show you how to do IR35 checks online.

Central assessment of VAT – HMRC’s process for late returns

Posted by Mark Ingle on October 24, 2025When you miss a VAT return, HMRC does a central assessment of VAT making it important to file on time to avoid potential enforcement action.

VAT mistakes that cost thousands – and how to avoid them

Posted by Kirsty Demeza on October 16, 2025VAT mistakes are easy to make and can cost your business thousands. In this article we look at common errors and how to avoid them.

VAT error correction explained

Posted by Karen Jones on October 13, 2025If you think you’ve made a mistake on your VAT return, you need to use the right method of VAT error correction. We show you how.