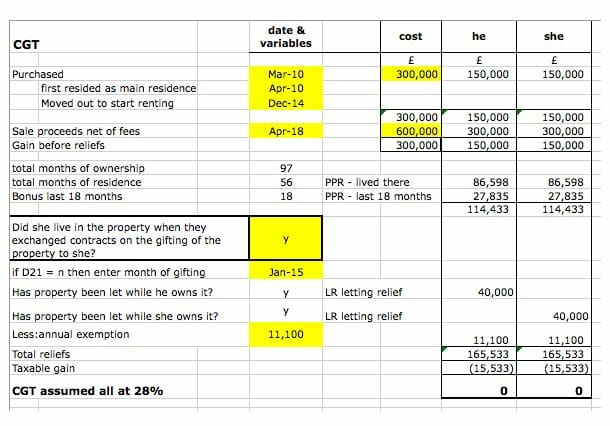

Capital Gains Tax on sale of property – express service

Posted by Kirsty Demeza on November 3, 2025Capital Gains Tax on sale of property – you have only 60 days to calculate the tax due, declare it to HMRC and pay over the tax.

IR35 checks – did you know you could do them online?

Posted by Jon Pryse-Jones on October 29, 2025IR35 checks are important for hiring organisations – get them wrong and it gets expensive. We show you how to do IR35 checks online.

Central assessment of VAT – HMRC’s process for late returns

Posted by Mark Ingle on October 24, 2025When you miss a VAT return, HMRC does a central assessment of VAT making it important to file on time to avoid potential enforcement action.

VAT mistakes that cost thousands – and how to avoid them

Posted by Kirsty Demeza on October 16, 2025VAT mistakes are easy to make and can cost your business thousands. In this article we look at common errors and how to avoid them.

VAT error correction explained

Posted by Karen Jones on October 13, 2025If you think you’ve made a mistake on your VAT return, you need to use the right method of VAT error correction. We show you how.

Minimum Wage – employers be careful!

Posted by Jon Pryse-Jones on October 3, 2025Not so long ago, more than 200 employers were named and shamed for not complying with the National Minimum Wage. Don’t let it happen to you!

HMRC bank account tax raids starting up

Posted by Jon Pryse-Jones on September 25, 2025HMRC bank account tax raids are set to take off with powers to dip into the accounts of people and businesses owing more than £1,000.

VAT on business gifts explained

Posted by Karen Jones on September 22, 2025If you give gifts to staff, customers or clients, you need to be aware of the rules relating to VAT on business gifts. We take a closer look.

HMRC surveillance team doubles – what powers has the taxman?

Posted by Jon Pryse-Jones on September 11, 2025Between 2023 and 2025, the HMRC surveillance team nearly doubled in size. But what powers does the taxman have?

Reporting tax fraud nets whistleblowers £509,000

Posted by Jon Pryse-Jones on September 5, 2025Reporting tax fraud netted whistleblowers over £500,000 during the last tax year. But would a more transparent system recoup more?