Finance director – using an accountant at your board meetings – 5 benefits

Posted by Kirsty Demeza on October 9, 2023Finance director – have you thought about using an accountant at your board meetings to fulfil the role of an outsourced finance director?

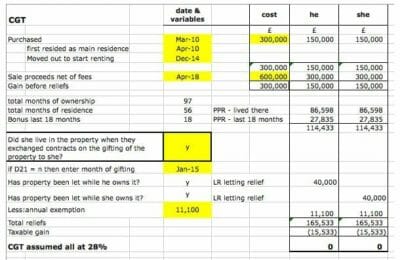

Capital Gains Tax on sale of property – express service

Posted by Kirsty Demeza on October 6, 2023Capital Gains Tax on sale of property – you now have only 30 days to calculate the tax due, declare it to HMRC and pay over the tax.

Your business credit rating – and how to improve it

Posted by Mark Ingle on October 4, 2023Did you know that most business owners have never checked their business credit rating? We share our top tips for improving your credit score

IR35 checks – did you know you could do them online?

Posted by Jon Pryse-Jones on October 2, 2023IR35 checks are important for hiring organisations – get them wrong and it gets expensive. We show you how to do IR35 checks online.

Most Self Assessment Tax Returns are handled by Accountants for good reason

Posted by Karen Jones on October 2, 2023Innocent errors on a tax return can be a red flag for HMRC and may well draw unwanted attention to the taxpayer. Engaging an accountant can help.

Central assessment of VAT – HMRC’s process for late returns

Posted by Karen Jones on September 28, 2023When you miss a VAT return, HMRC does a central assessment of VAT. Changes to the system mean it’s more important than ever to file on time. If you don’t, it may be more likely you’ll experience enforcement action.

Flexible Working – how does it work?

Posted by Jon Pryse-Jones on September 27, 2023Flexible working – are we moving away from working in a physical office?

Business valuation – what is your company worth?

Posted by Andy Green on September 26, 2023Thinking about getting your business valued? We consider the key criteria for completing an accurate SME business valuation

Sole trader or limited company? What should I choose?

Posted by Mark Ingle on September 25, 2023Starting a new business but not sure whether you should be a sole trader or limited company? Then read on…

Business continuity plan – is your small business prepared?

Posted by Andy Green on September 22, 2023Don’t go out of business – be prepared by creating a business continuity plan that will make you ready for anything.