Looking for free MTD-compliant Landlord software?

You’ve got it – with THP’s specialist Landlords Platinum Accounting Service

Are you looking for free landlord software? A cloud accounting package that will help you as a Landlord manage your buy-to-let portfolio? Something that will let you manage all your property portfolio finances in one place?

If the answer is ‘YES!’ then look no further.

As The Landlord’s Accountants, THP has teamed up with Hammock – the Making Tax Digital compliant software made by landlords for landlords. Hammock is designed exclusively for busy landlords who want a powerful set of tools to help them manage their Buy-to-Let property portfolio.

To benefit from this free offer, all you need to do is sign up to our dedicated Landlord’s Platinum Accounting Service and the software is yours to use, completely free of charge. Better still, you will benefit from a whole range of specialist landlord services designed to help you maximise your profits, lower your tax bills and develop your Buy-to-Let portfolio.

How our Landlords’ Platinum Accounting Service works

If you want to enjoy free landlord software, plus have a team of buy-to-let specialist accountants working on your behalf, you simply need to sign up for our Landlords’ Platinum Accounting Service.

Our Platinum service is ideal, whether you are a landlord with a small larger portfolio with limited time to handle bookkeeping work or if you have a large portfolio of properties to manage. It provides a whole range of benefits, from fee-free mortgages and priority access to our landlords’ Capital Gains Tax service through to discounted Wills and Estate Planning. You’ll also gain access to our landlords’ advanced tax planning services, to help you to decide on the best way for you to structure your growing property portfolio. You will also be included in our Tax Investigation Fee Protection Scheme which helps with the costs in defending any future HMRC investigations into your affairs.

Check out the table below to see what is included in our Platinum service.

This service depends on us compiling and submitting your annual Self-Assessment Tax Return. Why? Because only by having a complete picture of your overall financial situation can we offer you the very best tax advice.

| Platinum service for Landlords |

|

|---|---|

| Free Landlord MTD software | |

| Your Personal Landlord Account Manager | |

| Free software onboarding session (via Zoom) | |

| Preparation of annual Self-Assessment tax returns for you and your spouse/partner | |

| Priority access to Landlord advanced tax planning services | |

| Priority access to Capital Gains Tax services on BTL property sales | |

| 15% discount on Wills and Estate Planning services | |

| Arrangement of fee-free Buy-to-Let mortgages via our mortgage broker partners | |

| Tax Investigation Fee Protection (Rental Income to £50k included at no charge) | |

| Free Property Bank Account arranged via Hammock (Optional) |

Book a no obligation call with Ian, our MTD expert

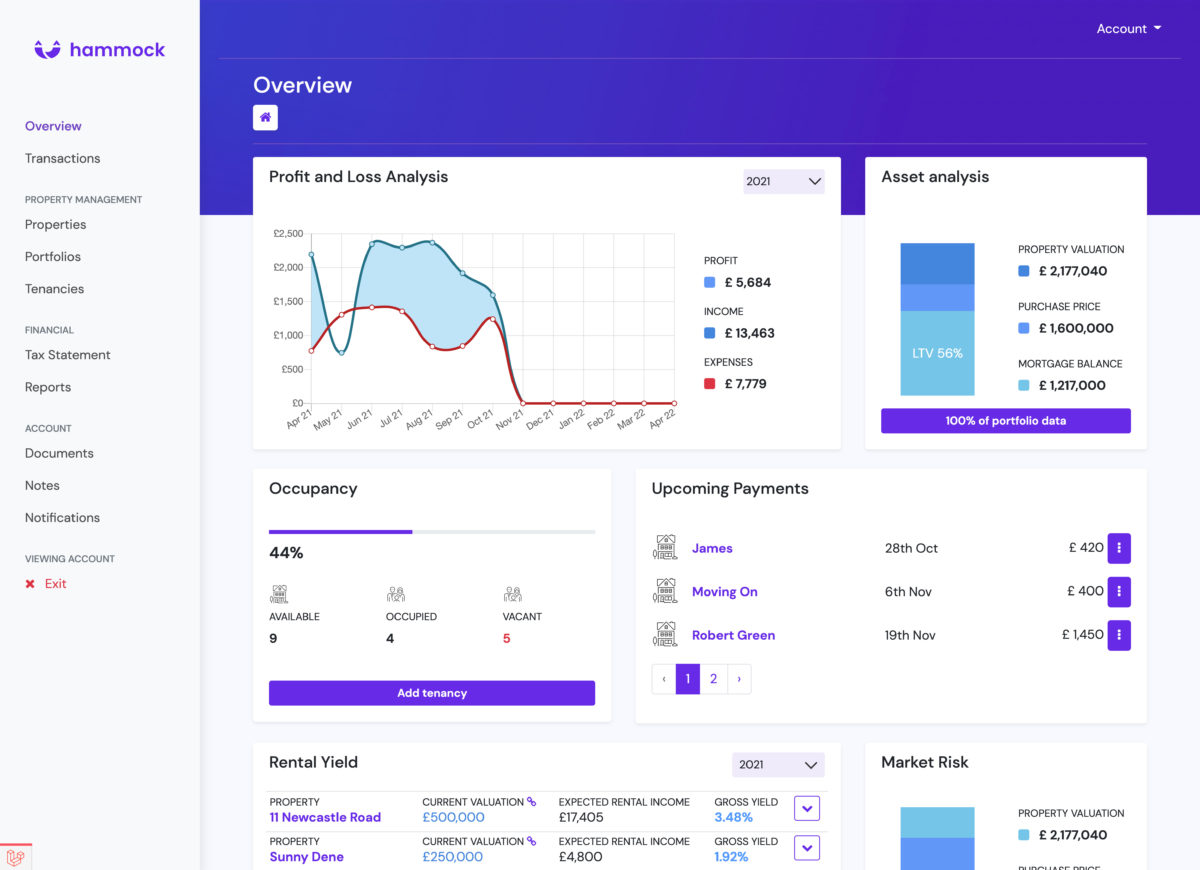

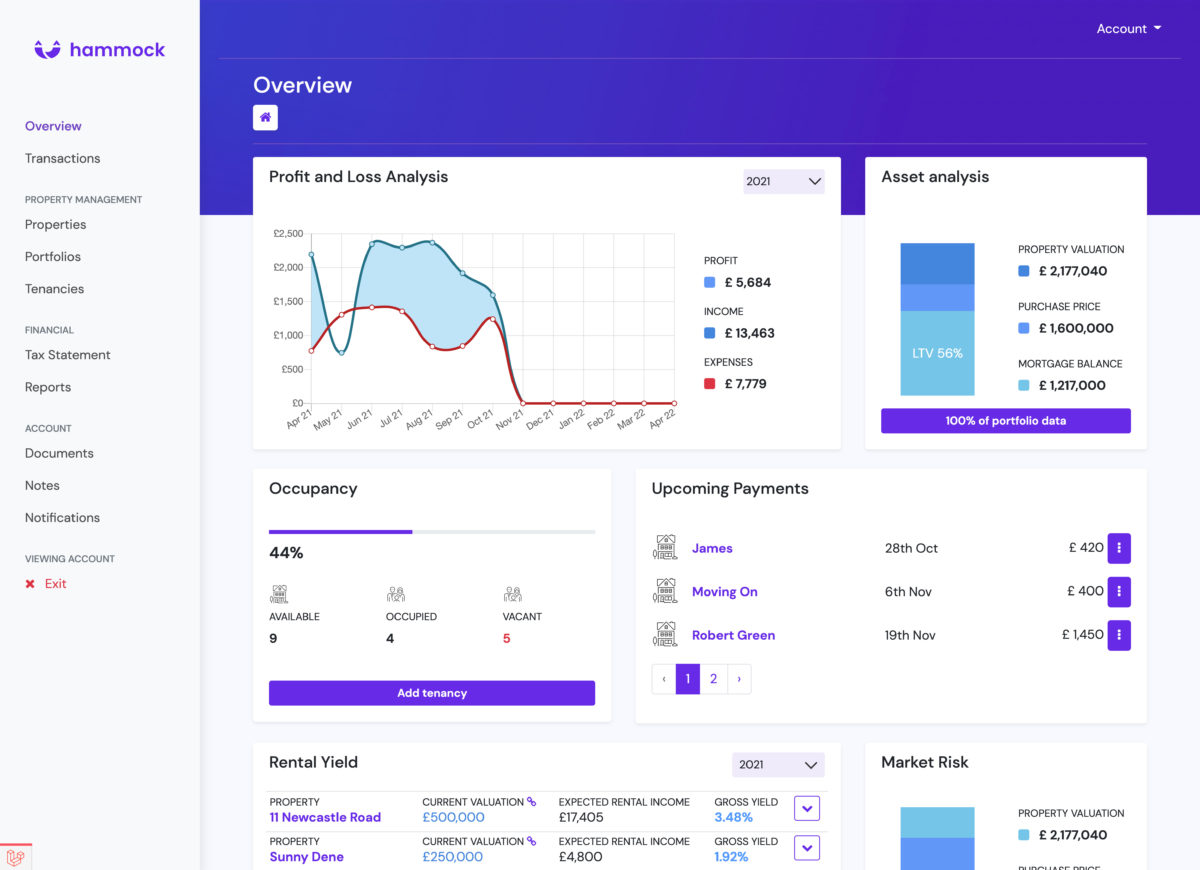

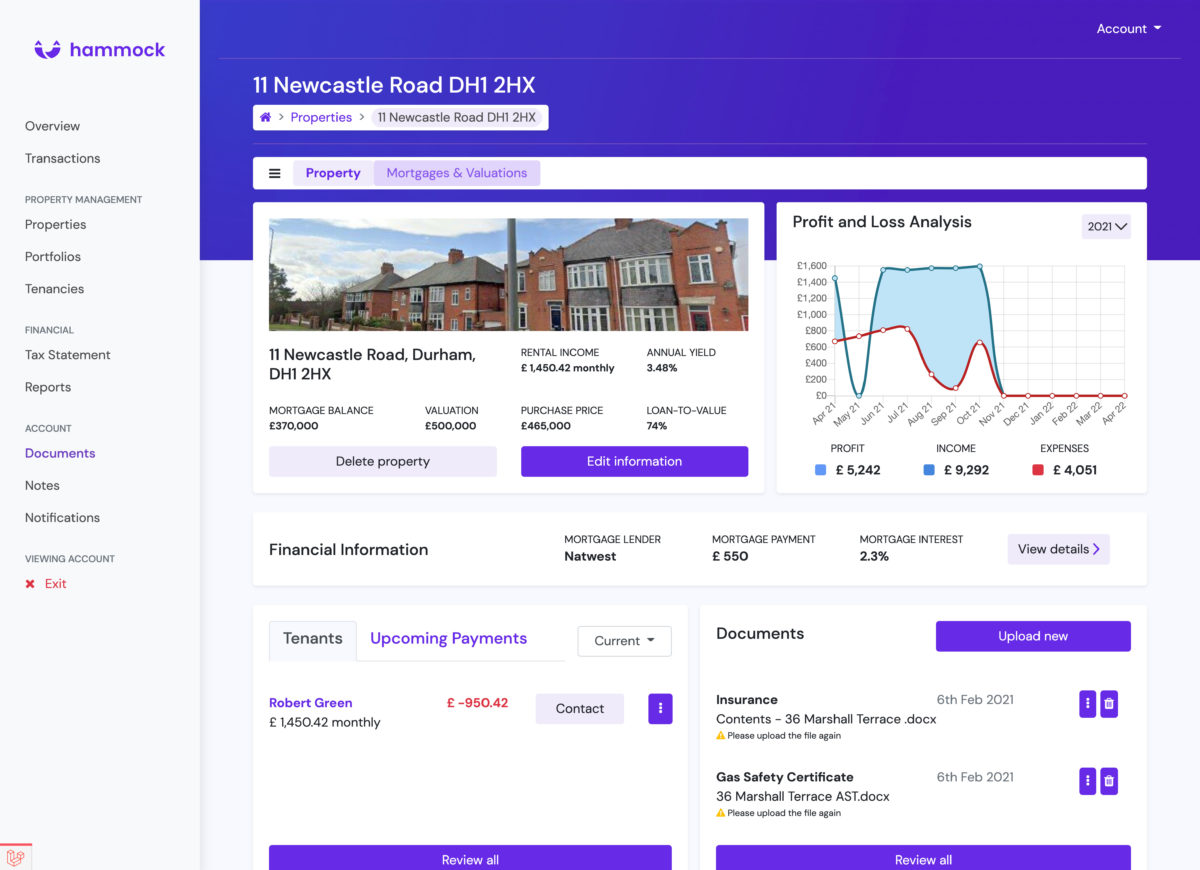

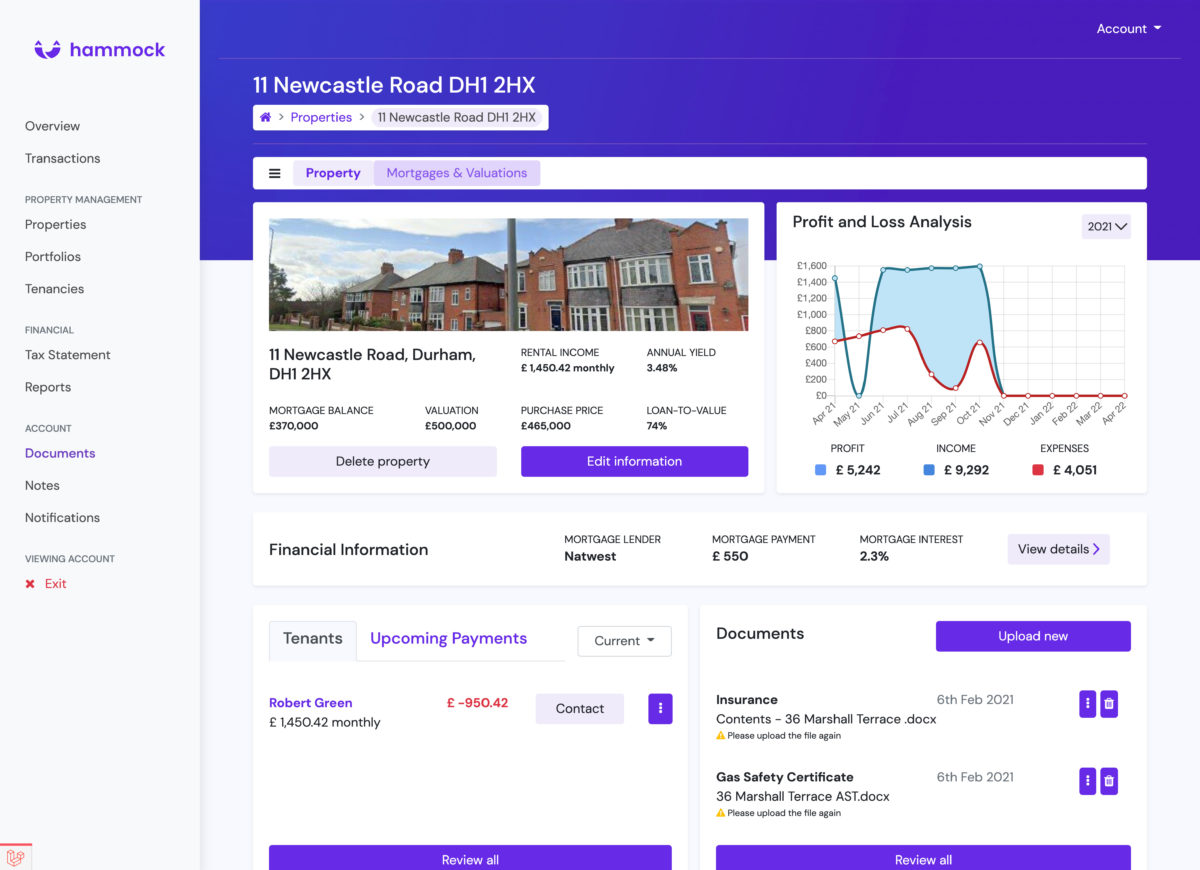

What is Hammock landlord software?

You may be wondering what Hammock software is, and why we’re giving access to it away for free.

Quite simply, we’ve reviewed many of the MTD software systems for landlords on the market and we believe that Hammock is currently the best landlord software out there.

These are just some of the benefits it offers:

- Easy and intuitive to use

- Offers all the functions most busy landlords require

- Connect as many bank account feeds as you need

- Automatically reconciled rent payments and property expenses

- Tax liability calculated in real time.

- Detailed insights such as loan-to-value, rental yields, arrears balance and occupancy rates.

- Reminders for things like insurance and certificate renewals.

When you use Hammock in conjunction with THP’s Landlords’ Platinum Accounting Service, it becomes even more powerful. You can share your financial information with our specialist accountants, giving them a powerful tool to identify tax savings and other opportunities.

So that’s why we’re giving it away for free. For as long as you continue with our Landlords’ Platinum service, you won’t pay a penny to use this exceptional software. And in case you were wondering, yes – it will always be compliant for Making Tax Digital.

Why switch to specialist landlord software now?

As you’ve seen, switching to Hammock’s specialist landlord software will make managing your portfolio more of a pleasure than a hassle.

It will take up far less of your time than if you are using spreadsheets for example, as its built in artificial intelligence will ensure that once setup, most bank receipts and payments are allocated to the correct income and expense accounts automatically. But there’s another good reason for switching now: the dreaded Making Tax Digital (MTD) changes that are just around the corner.

MTD is the government initiative that’s moving us all over to digital record keeping. As a landlord, you will have to sign up to Making Tax Digital for Income Tax by April 2026 (if you earn more than £50,000) or April 2027 (if you earn more than £30,000). As soon as that happens, managing your portfolio using spreadsheets or non-MTD-compliant software will become complex, technically demanding and extremely frustrating.

Do you really want to turn yourself into an expert on fiddly Excel ‘bridging software’ for MTD? Or would you rather use simple, intuitive and feature rich landlord software to get the job done simply and automatically?

By signing up to our Landlords’ Accounting Service, you guarantee that your record keeping will be compliant when MTD comes in – and you’ll have peace of mind that you won’t face penalties. Also, at a time when the Buy-to-Let market is tougher than ever, you’ll benefit from expert advice from accountants who help hundreds of landlords increase their profits and expand their portfolios?

Apply for your no obligation quote now to get started. Or if you’re still not convinced, feel free to arrange a call from one of our dedicated team.

How to get started with the Zoom onboarding session

If you’re interested in our dedicated Landlords’ Platinum Accounting Service, apply for a quote today. Once you have provided us with a few details, we’ll be able to provide you with a tailored quotation.

If you tell us you wish to proceed, we will sign you up and add you to our online platform. You will then receive an invitation by email to register for the service. After a few simple details are entered, you will be granted access to your dashboard.

Following that, you will receive a call from the onboarding team to arrange a convenient time for a Zoom meeting. During that meeting you will be led through a live demo on the different functions of the software and how it works.

Amongst other things you will be shown how to:

- Enter a property

- Enter a tenancy

- Link your property bank accounts and synchronise transactions

- Allocate transactions to the correct income and expense category by property

- Use all the reports, including the tax calculators

- Record and set reminders for important events such as renewal of insurances, Gas safety certificates, EICRs etc.

By the end of the session, you will have a good understanding of what the system does. We will be able to show you the different reports and useful information you’ll have access to, as well as to answer any questions you may have.

Additional ongoing assistance can easily be accessed from within the software itself by using the live messaging/chat system which is manned by experts who are ready to answer any questions that arise when using the software.

Book a no obligation call with Ian, our MTD expert

Frequently Asked Questions

At THP, our specialist landlord accountants have made it a mission to try out as many landlord software packages as possible. In our opinion, Hammock is the best small landlord software on the market, as well as the best small rental property management software we’ve found. That’s why we’re proud to offer Hammock to clients of our Landlord’s Accounting Service.

Yes you do. If you already have a separate bank account set up for your property transactions you can link that to the software. If you do not have one, we can provide you with one as part of the package.

It is considered bad practice to use your ordinary personal account for property transactions for a number of reasons. Your bookkeeping would become more inefficient and time consuming as the volume of bank transactions to be posted and allocated would be much higher.

Yes, the software was designed with jointly owned properties and properties owned by companies in mind.

Whilst submissions via MTD won’t be possible or compulsory for a while yet, it’s far better to start getting everything ready now. We have compared the time spent in using this software to using spreadsheets and it takes far less time using software as most postings are carried out automatically using the built in Artificial Intelligence systems. In addition you will have access to our tax planning services to help you to manage your BTL portfolio in the most tax efficient way.

You don’t need to! Hammock is a secure, cloud-based software meaning you can access it via any web browser. There’s also a Hammock app for both iOS and Android.

Hammock is designed to be used as standalone software for landlords, so you won’t need any other accounting software. However, we can help you migrate your financial information from Quickbooks or other packages into Hammock.

Hammock can help work out your tax liabilities, but you have to make sure you put the right information in. Our bookkeeping service can make it simpler for you to accurately work out the taxes you owe.

If there are changes to taxes such as income tax, capital gains tax or stamp duty, Hammock will be updated automatically to take these into account.